Major Markets of Global Solar Energy

New data released by the International Renewable Energy Agency (IRENA) shows that renewable energy continued to grow and gain momentum despite global uncertainties. By the end of 2021, global renewable generation capacity amounted to 3 064 Gigawatt (GW), increasing the stock of renewable power by 9.1 per cent.Although hydropower accounted for the largest share of the global total renewable generation capacity with 1 230 GW, IRENA’s Renewable Capacity Statistics 2022 shows that solar and wind continued to dominate new generating capacity. Together, both technologies contributed 88 per cent to the share of all new renewable capacity in 2021. Solar capacity led with 19 per cent increase, followed by wind energy, which increased its generating capacity by 13 per cent.

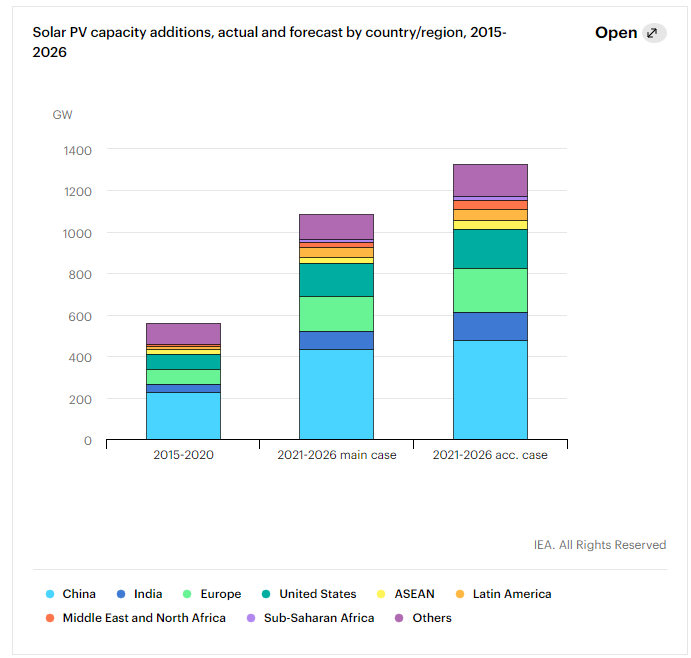

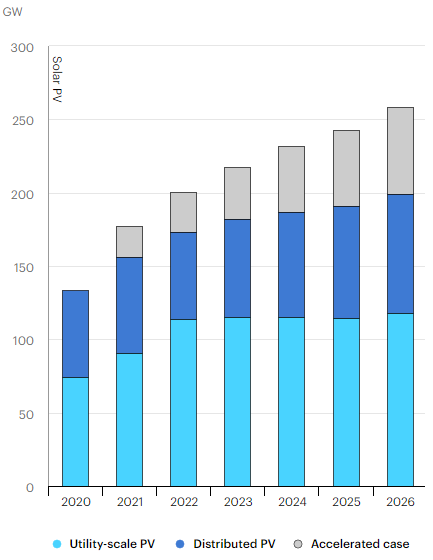

We can learn from International Energy Agency (IEA) that there is an increase in new capacity in all major world regions in previous years, total global solar capacity has now outgrown wind energy capacity. And Off-grid capacity grew by 466 MW in 2021 (+4%) to reach 11.2 GW. Globally utility-scale PV and distributed PV in 2022~ 2026 will under steady development.

Under the accelerated case, total growth of global solar PV capacity could be 22% higher with annual additions growing continuously, reaching almost 260 GW by 2026. The upside is largest in key markets such as China, Europe, the United States and India, but considerable growth potential remains in nascent markets such as sub-Saharan Africa and the Middle East. However, reaching the accelerated case will require the major markets to address their persistent challenges. These are the highlights:

China: Clarify the rules around the new renewable portfolio standard and green certificate scheme for utility-scale and large-scale commercial applications. Continue support for residential solar PV following the phase-out of incentives in 2021.

United States: Extend investment tax credits and the monetisation of credits through a direct-pay scheme.

India: Improve the distribution companies’ financial health, reducing delays in signing PPAs following solar PV auctions, accelerate grid expansion and improve the remuneration for distributed PV applications.

European Union: Increase auction capacity and improve participation rates in utility and large commercial-scale auctions via smoother permitting procedures when these are required for bidding. Increase support for distributed solar PV through the EU resilience and recovery fund.

Japan: Smooth the transition to the feed-in premium (FIP) scheme to build up a declining project pipeline from the former feed-in tariff (FIT).

Middle East and North Africa: Increase the frequency of auction rounds, and speed up bidder selection and contractual negotiations to accelerate utility-scale PV rollout. More rapid expansion of transmission and distribution grids allows the connection of additional solar PV capacity.